Vancouver, British Columbia / March 30, 2023 – Usha Resources Ltd. (“USHA” or the “Company”) (TSXV: USHA) (OTCQB: USHAF) (FSE: JO0), a North American mineral acquisition and exploration company focused on the development of drill-ready battery and precious metal projects, would like to remind shareholders of the upcoming share distribution record date (the “Record Date”) of April 12, 2023, with respect to the plan of arrangement (the “Arrangement”) among the Company, Formation Metals Inc. (“Formation Metals” or “FMI”) and the shareholders of the Company (the “USHA Shareholders”).

Under the terms of the Arrangement and upon completion of the share exchange prescribed by Article 3 of the Arrangement, the USHA Shareholders of record at the close of business on the Record Date will receive one (1) common share of FMI (each a “Formation Metals Share”) with respect to every five (5) common shares of USHA (“USHA Share”) held on the Record Date, with fractions rounded down to the nearest whole number. For example, upon completion of the Arrangement, for each 10,000 common shares of USHA owned on the Share Distribution Record Date, the USHA Shareholder will own 2,000 common shares of FMI. USHA common shares will be exchanged for new USHA common shares on a one-to-one basis. USHA Shareholders will continue to own the same number of USHA common shares as they did on the Record Date. The Formation Metals Shares will be issued to the USHA Shareholders on or around April 17, 2023 (the “Payment Date”).

The Arrangement is expected to become effective on the Record Date.

USHA Shareholders must hold their USHA common shares on the Record Date in order to receive their pro rata portion of the Formation Metals Shares being distributed pursuant to the Arrangement.

By way of this news release, the Company is also providing notice to its warrant holders and option holders with respect to the Record Date. To receive Formation Metals Shares pursuant to the Arrangement, a person must be a holder of USHA Shares as of the Record Date. If an option holder or a warrant holder does not exercise his or her warrants or options on or before the Record Date, he or she will not receive Formation Metals Shares and there will be no changes with respect to the number, terms and conditions of the issued warrants and options of the Company.

FMI will then hold the Company’s interest in the Nicobat Nickel Project and will focus on the advancement of this project, while USHA will retain and focus on the advancement of exploration projects in the lithium space, including the Jackpot Lake Lithium Brine Project where the Company is presently undertaking is maiden drill program with a goal of defining a 43-101 resource, and its newly acquired White Willow Lithium-Tantalum Project, the first of the Company’s planned expansion into the hard-rock pegmatite space (see the Company’s news release dated March 28, 2023). For updates on the drill program at Jackpot Lake and its recent land expansion, please see the Company’s news release dated February 7, 2023, February 16, 2023, February 21, 2023and February 28, 2023.

USHA Shares will trade on a “due bill” basis until the close of trading on the Payment Date, i.e. the Due Bill Trading Period. The details of the Due Bills Trading will be announced later by a separate news release. Additional information regarding the terms of the Arrangement are set out in the Company’s management information circular dated November 15, 2022, and the news releases dated February 9, 2022, November 17, 2022, November 29, 2022, December 21, 2022, January 10, 2023, March 2, and March 15, 2023, all of which are available for viewing on the Company’s SEDAR profile at www.sedar.com.

The Nicobat Nickel Property

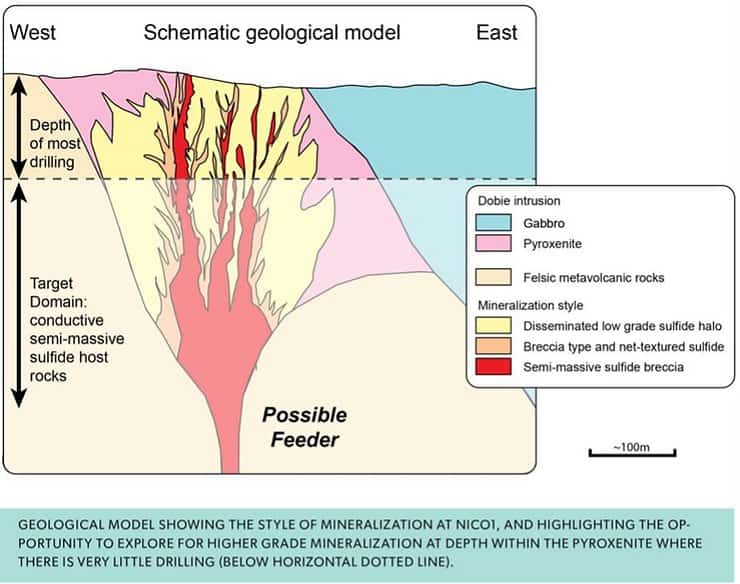

The Nicobat Nickel Property is a nickel-copper-PGE project located in Dobie Township, Northwest Ontario 21 kilometres south of New Gold’s Rainy River Mine which hosts the Zone 34 nickel discovery.

Historic exploration work between 1952 and 1972 included over 15,000 metres of drilling, 220 drill holes and numerous bulk samples that identified a non-compliant historic resource of 5.3 Mt grading 0.24% Ni that contained a high-grade zone of approximately 225,000 tons grading 0.87% Ni.

Recent exploration work includes over 4,000 metres of drilling that has confirmed high-grade nickel-copper shoots do exist and are considerably better than previously recorded in the historical drilling, with drillhole A-04-15 intersecting from surface to approximately 63.75 metres a weighted average of 1.05% nickel and 2.18% copper that included an approximately 9.8-metre interval of 1.92% Ni from 53.95 to 63.75 metres.

The targeted feeder conduit measures approximately 305 metres by an average of 60 metres in width to a depth of 245 metres that is potentially open at depth and down-plunge to the north and is composed of cumulate textured olivine gabbro. This magma conduit sits in a larger norite body at the base of the Dobie Gabbro. The historical assessment data records high-grade “ribs”, one of which includes the zone described above. Future work will, therefore, focus on making the historic resource compliant current and expanding on the work completed to assess for other high-grade “ribs” and the potential high-grade feeder zone as shown in the model below.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Andrew Tims, P.Geo., a qualified person as defined by National Instrument 43-101.

About Usha Resources Ltd.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha’s portfolio of strategic properties provides target-rich diversification and consist of Jackpot Lake, a lithium project in Nevada; Nicobat, a nickel‑copper‑cobalt project in Ontario; and Lost Basin, a gold-copper project in Arizona. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

USHA RESOURCES LTD.

“Deepak Varshney” CEO and Director

For more information, please call Tyler Muir, Investor Relations, at 1-888-772-2452, email [email protected], or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This news release contains “forward-looking information” under applicable Canadian securities legislation. Such forward-looking information reflects management’s current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry. These statements include proposed terms of the spinout transaction, proposed business plans for each of Usha and FMI, the listing of FMI’s Shares, the anticipated benefits of the transaction, and disclosure of additional details concerning the transaction. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Usha cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by many material factors, many of which are beyond their respective control. Such factors include, among other things: determination of acceptable terms for the proposed spinout transaction, risks and uncertainties relating to the receipt of approvals to proceed with and complete the transaction and the satisfaction of the conditions precedent to the completion of the transaction, unexpected tax consequences, the market valuing Usha and FMI in a manner not anticipated by management of the Company, the benefits of the spinout transaction not being realized or as anticipated, and each of Usha and FMI being unable to add additional properties to their respective portfolios. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company does not undertake to publicly update or revise forward-looking information.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.