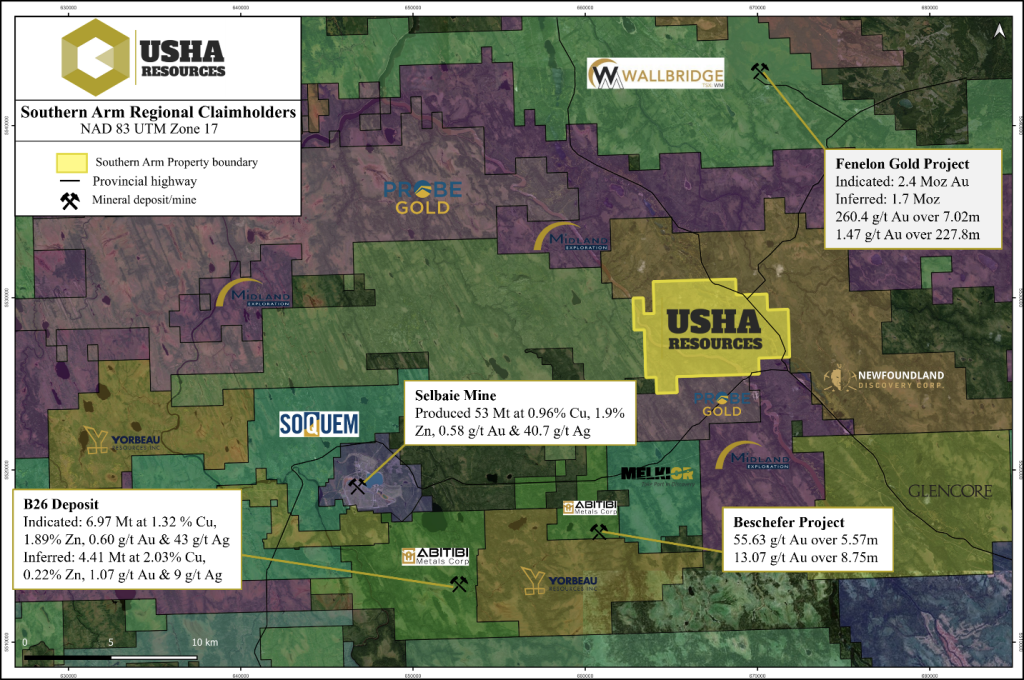

Vancouver, British Columbia / July 17, 2024 – Usha Resources Ltd. (“USHA” or the “Company”) (TSXV: USHA) (OTCQB: USHAF) (FSE: JO0), a North American mineral acquisition and exploration company, is pleased to announce that the Company has executed an option (the “Option” or “Option Agreement”) with Abitibi Metals Corp. (“Abitibi” or the “Optionor”) for the right to purchase an undivided 100% interest in the Southern Arm property (“Southern Arm” or the “Property”, Fig. 1).

Highlights:

- Southern Arm hosts a ~7.3 km copper-gold trend along the regional-scale Bapst fault within the volcanic rocks of the Brouillan-Fenelon Group, which hosts the nearby Selbaie Mine (~15 km W) and B26 Deposit (~16 km SW) and is prospective for polymetallic VMS-style mineralization.

- Multiple drill targets identified including “Hollywood” where anomalous metals values have been identified over a ~1.8 km footprint that is open along strike.

- The Property is situated in a region famous for its endowment in precious and base metals. Notable nearby projects include:

- ~16 km from the high-grade B26 Copper deposit, which hosts an indicated resource of 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag) and an inferred resources of 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag; and

- ~15 km from the Fenelon Gold Project, which hosts as indicated resource of 2.4 Moz Au and inferred 1.7 Moz Au; and

- ~15 km from the historic Selbaie mine, which produced 53 Mt at 0.96% Cu, 1.9% Zn, 0.58 g/t Au, 40.7 g/t Ag.

- Exploration targets at Southern Arm were produced by the Abitibi Metals technical team, who will be acting in an advisory role as the Company progresses the proposed exploration strategy. Fully funded drill program planned for Fall 2024.

- The Southern Arm Option was negotiated following payment of US$75,000 by Stardust Power, Inc. (MC $675M) pursuant to the Letter of Intent granting the right to earn up to a 90% interest subject to a 2% Net Smelter Royalty in Usha’s Jackpot Lake Lithium Brine Project for total consideration that could total up to US$26,025,000 over five years inclusive of payments comprising US$1,525,000 cash, US$750,000 stock, US$15,750,000 stock or cash at Stardust Power’s election, and a work commitment of (US$8M).

The full details of the LOI are included in Usha’s press release dated May 17, 2024. The transaction is subject to the satisfaction of a number of conditions. The Company cautions that there is no guarantee that the Definitive Agreement will be completed.

Deepak Varshney, CEO of Usha Resources, commented: “We are very excited to partner with Abitibi Metals on Southern Arm, which establishes Usha as a diversified metals company in North America with an opportunity to develop a company-making asset in the best mining province in Canada. Through their rigorous systematic exploration approach, we are starting with a 7 km+ trend with multiple targets including Hollywood, where anomalous metals values have been identified over a ~1.8 km footprint that remains open. We look forward to working with the Abitibi team to advance Southern Arm and plan on completing a fully funded maiden drill program this coming Fall.”

Figure 1 – Regional Claim Map

Southern Arm Property Details

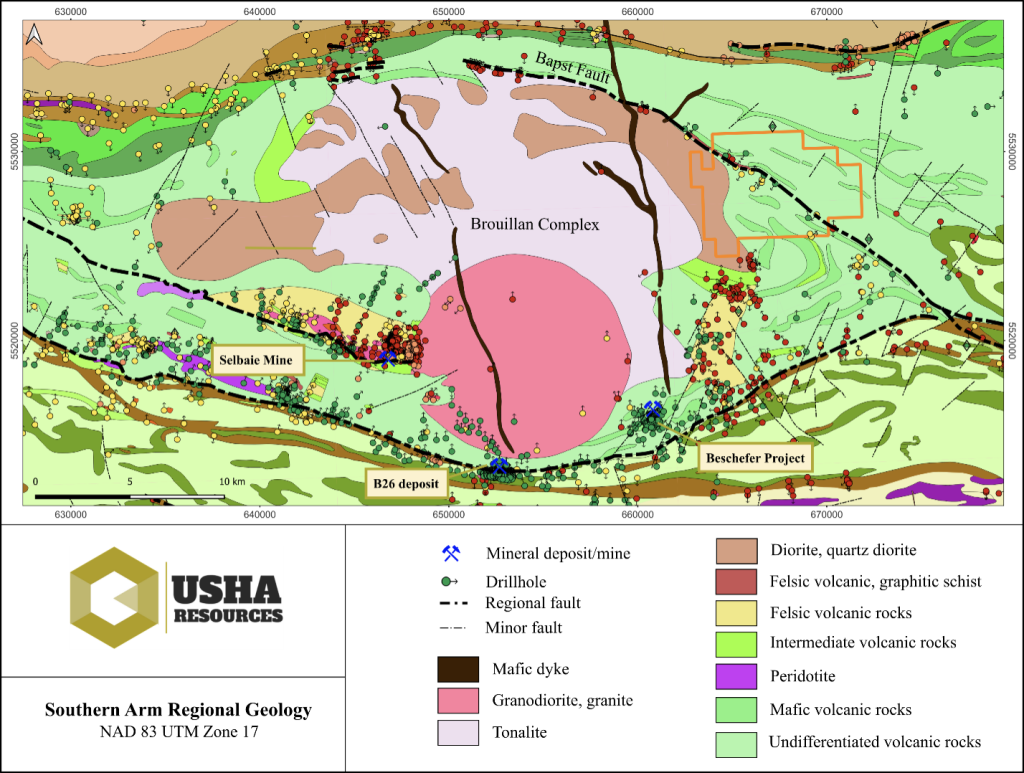

The Property comprises 76 claims totaling more than 42 km2 in the deposit-rich Abitibi mining camp (Fig. 1). The Property contains geology favourable for polymetallic VMS-style mineralization (Fig. 2) and historic drill logs documented brecciated felsic exhalite horizons that underwent chlorite and sericite alteration associated with elevated Zn values (Fig. 2).

It is situated on the eastern side of the Brouillan pluton and the bedrock geology is dominated by the volcanic rocks of the Brouillan-Fenelon Group, which also host the nearby Selbaie Mine and B26 Deposit. These rocks are situated along the regional-scale Bapst fault, which represents a splay of the Southern Detour deformation and is associated with Zn, Pb Ag, Mo and Cu mineralization along trend.

The property hosts a ~7.3 km conductive trend with multiple drill targets already identified including “Hollywood” where anomalous metals values have been identified over a ~1.8 km footprint that remains open.

Figure 2 – Bedrock geology of the Southern Arm Property

Terms of the Agreement

Pursuant to the Option Agreement, the Company may acquire a 100% interest in the Property by issuing an aggregate of 5,000,000 common shares in the capital of the Company and completing $2,000,000 of work expenditures as indicated in the table below:

| Payment | Shares | Work Commitment |

| Signing | 2,500,0001, 2 | – |

| 1st Anniversary | 2,500,0002 | – |

| 2nd Anniversary | – | 2,000,000 |

| Total | 5,000,000 | $2,000,000 |

| Notes | Payable within fifteen (15) days from receipt of approval to the Agreement from the Exchange (the “Approval”). Shares of the Company are to be issued at a deemed value based on the Discounted Market Price at the time of issuance. | |

The Company has granted to the Optionor a 2% net-smelter returns royalty (the “NSR”) on the claims making up the Property with no historical royalty.

The transaction contemplated, including the issuance of the shares, is subject to the final approval of the TSX Venture (the “Exchange”). The shares will be subject to the applicable hold periods in accordance with securities laws in Canada and exchange policies.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Deepak Varshney, P.Geo., a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionors were reviewed by the qualified person. The information provided has not been verified and is being treated as historic non-compliant intercepts.

About Usha Resources Ltd.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality critical metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha’s portfolio of strategic properties provides target-rich diversification and includes Southern Arm, a copper-gold VMS project in Quebec, Jackpot Lake, a lithium brine project in Nevada and White Willow, a lithium pegmatite project in Ontario that is the flagship among its growing portfolio of hard-rock lithium assets. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

USHA RESOURCES LTD.

For more information, please call 778-899-1780, email [email protected] or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include “forward-looking information” under applicable Canadian securities legislation. Such forward-looking information reflects management’s current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.