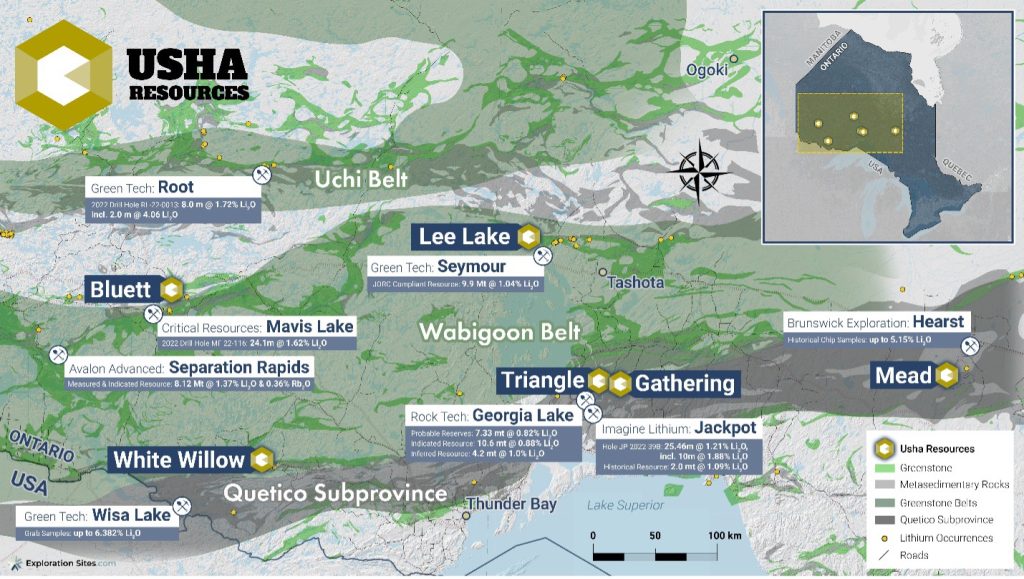

Vancouver, British Columbia / May 3, 2023 – Usha Resources Ltd. (“USHA” or the “Company”) (TSXV: USHA) (OTCQB: USHAF) (FSE: JO0), a North American mineral acquisition and exploration company focused on the development of drill-ready battery and precious metal projects, is pleased to announce that, subject to the approval of the TSX Venture (the “Exchange”), the Company has executed five (5) options (the “Option Agreements”) with 2758145 Ontario Ltd. (the “Vendor”) of Atikokan, Ontario, for the right to purchase an undivided 100% interest in five (5) additional lithium pegmatite projects located in Ontario: the “Lee Lake”, “Mead”, “Bluett”, “Gathering Lake” and “Triangle Lake” Projects.

“We are very pleased to be able to add such quality projects to our growing portfolio of hard-rock lithium assets,” said Deepak Varshney, CEO of Usha Resources. “Each of these properties has the technical merit to be the next major discovery in Ontario’s growing lithium hotbed. As we leverage our experience and initial success at Jackpot Lake to help drive friendly terms for these latest acquisitions, our Australian relationships and on-going discussions are also heating up with the shared belief that all of our Canadian assets, including White Willow, can develop into successful and fiscally prudent partnerships that benefit our shareholders and move these projects forward while carefully managing our share structure.”

The acquisition of these assets is a continuation of the Company’s strategy to build an accretive portfolio of highly complementary hard-rock assets to its 100% owned flagship Jackpot Lake Lithium Brine Project (“Jackpot Lake”), where the Company is presently undertaking its maiden drill program with the goal of defining a 43-101 resource. On April 12, 2023, the Company reported the highest lithium grades ever at the Project, assaying 820 ppm Li, with an average of 334 ppm Li in thirty samples collected from shallow surface soils (<500 ft), at over four times the reported historical average, comparing very favourably to the reported average of 100 ppm for the Esmeralda Formation, one of the potential sources of the lithium enrichment for the brines present in Clayton Valley which hosts Albemarle’s Silver Peak Lithium Brine Mine, the only producing lithium operation in the United States[i].

The Company is presently awaiting results from the limited drilling completed as part of the first hole at Jackpot Lake and will shortly resume drilling to 2,000 feet in order to complete well installation to the bottom of the basin and sampling of the higher-porosity sand and conglomerate zone that is the focus for expansion in Clayton Valley and where the Company believes the best potential brines may be present.

“This summer will be a very busy time for the Company as we complete the initial two drill holes at Jackpot Lake and begin exploration of our hard rock assets,” Varshney continued. “With a working capital of approximately 3 million, limited costs remaining at Jackpot Lake as we progress towards a maiden 43-101 lithium brine resource estimate, and the flexibility to potentially partner with strategic companies from Australia on our lithium pegmatite assets, Usha is well positioned to advance and grow from our market capitalization of just over 12 million today.”

Portfolio Highlights

- USHA has optioned 5 properties totalling 13,408 hectares, bringing its lithium property portfolio in Ontario to 7 properties covering 29,088 hectares.

- USHA is now positioned within four (4) additional major lithium-cesium-tantalum (”LCT”) pegmatite districts in Ontario with strong geological potential in addition to its district-scale White Willow Lithium-Tantalum Project (15,680 hectares) where it has almost 200 pegmatites and already has a confirmed fertile LCT pegmatite system bearing high-grade coarse-grained tantalite only known to be found at one other locality in Ontario which is the North Aubrey pegmatite at Green Technology Metals (GT1) Seymour Lake Project where GT1 has identified a 9.9 Mt resource at 1.04% Li2O (see the Company’s news release dated March 28, 2023).

- Gathering Lake and Triangle Lake: 8,938 hectares collectively within the prolific Georgia Lake pegmatite field, east of Rock Tech Lithium’s Georgia Lake Deposit, which hosts a 10.6 Mt indicated resource at 0.88% Li2O and 4.22 Mt inferred resource at 1.04% Li2O, and Imagine Lithium’s Jackpot Discovery which has identified 25.5 metres at 1.21% Li2O. Lithium occurrences in this field run along a primary fault which runs through Triangle Lake and is adjacent to Gathering Lake, suggesting that the mapped pegmatites on these properties may be highly fractionated LCT-pegmatites that bear spodumene.

- Lee Lake: 2,476 hectares adjacent to the west of GT1’s North Seymour Lake Claims and approximately 10 kilometres northwest of the Seymour Lake Project which hosts a 9.9 Mt resource at 1.04% Li2O. Lee Lake is within the same greenstone belt that is host to Seymour Lake and is adjacent to the claim block that will be a focus in 2023 for expansion by GT1 to make new proximal lithium discoveries and strategically grow the resource base for Seymour.

- Mead: 1,001 hectares adjacent on both east/west boundaries to Brunswick Resources’ Hearst Project, where it has an on-going drill program to assess the spodumene-bearing Decoy pegmatite and other pegmatites along trend to the west/southwest towards the Mead Property up to 2 kilometres from the claim boundary. Mead is located within the same granite-sedimentary belt as Decoy, and aerial imagery has confirmed the presence of outcropping pegmatites at Mead on trend with Decoy, suggesting the potential that this project may contain highly fractionated LCT-pegmatites that bear spodumene.

- Bluett: 993 hectares adjacent to Critical Resources Limited’s Mavis Lake Project, where it has already drilled over 20,000 metres and is drilling a further 20,000 in 2023 to define a maiden resource. Bluett is confirmed to white pegmatites in drill core and outcropping on surface and is on trend to the north of the Mavis Project within a greenstone belt that is near a major subprovince boundary, demonstrating strong potential that this project may contain highly fractionated LCT-pegmatites that bear spodumene.

The Terms of the Agreements

Pursuant to the Option Agreement, the Company may acquire a 100% interest in each of the “Lee Lake”, “Mead”, “Bluett”, “Gathering Lake” and “Triangle Lake” Projects by paying the consideration outlined in the table below:

| Property | Lee Lake | Bluett | Mead | Gathering Lake | Triangle Lake | |||||

| Payment | Cash | Shares | Cash | Shares | Cash | Shares | Cash | Shares | Cash | Shares |

| Signing | $10,000 | 75,000 | $5,000 | 50,000 | $5,000 | 50,000 | $12,000 | 50,000 | $13,350 | 50,000 |

| 1st Anniversary | $20,000 | 100,000 | $12,500 | 75,000 | $12,500 | 75,000 | $12,500 | 75,000 | $12,500 | 75,000 |

| 2nd Anniversary | $40,000 | 125,000 | $20,000 | 100,000 | $20,000 | 100,000 | $20,000 | 100,000 | $20,000 | 100,000 |

| 3rd Anniversary | $60,000 | 150,000 | $25,000 | 187,500 | $25,000 | 187,500 | $25,000 | 187,500 | $25,000 | 187,500 |

| Total | $130,000 | 450,000 | $62,500 | 412,500 | $62,500 | 412,500 | $69,500 | 412,500 | $70,850 | 412,500 |

The Company has granted to the Vendor a 2% net-smelter returns royalty (the “NSR”) for each of the “Lee Lake”, “Mead”, “Bluett”, “Gathering Lake” and “Triangle Lake” Options of which the Company may purchase half at any time for consideration of $1,000,000 per option.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Andrew Tims, P.Geo., a qualified person as defined by National Instrument 43-101.

About Usha Resources Ltd. Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha’s portfolio of strategic properties provides target-rich diversification and consist of Jackpot Lake, a lithium project in Nevada; White Willow, a lithium project in Ontario; and Lost Basin, a gold-copper project in Arizona. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTC Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

USHA RESOURCES LTD.

“Deepak Varshney”

CEO and Director

For more information, please call Tyler Muir, Investor Relations, at 1-888-772-2452, email [email protected], or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include “forward-looking information” under applicable Canadian securities legislation. Such forward-looking information reflects management’s current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.